“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million can diagnose.”

John Maynard Keynes

Aggri beads, small decorative beads made of glass, were at one point highly valued and used as money in ancient East and West Africa for centuries. These beads were difficult to produce with the glass making technology that was used in Africa then and thus maintained a degree of scarcity which cemented their monetary use. When European traders arrived in the 16th century they quickly caught on to the fact that these beads were valuable to the locals and started mass producing these beads in Europe which at the time had more advanced glass making technology.

The trading of real assets for counterfeit beads facilitated one of the largest wealth transfer events in history that paralyzed African societies for centuries to come. These beads were shipped into Africa in large quantities ultimately leading to a slow but sustained plundering of African natural resources, and more importantly, time. Aggri beads were later nicknamed “Slave-beads” as newly impoverished Africans sold themselves or others as slaves to the Europeans. Slave beads—one of history’s many monetary systems weaponized by counterfeiters—became instrumental in the multi-century trans-Atlantic slave trade. (1)

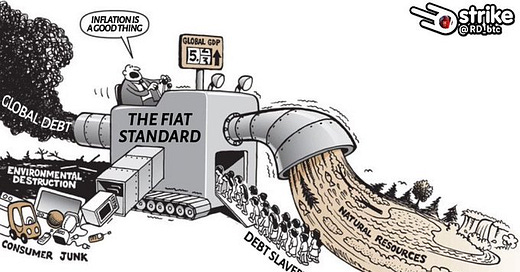

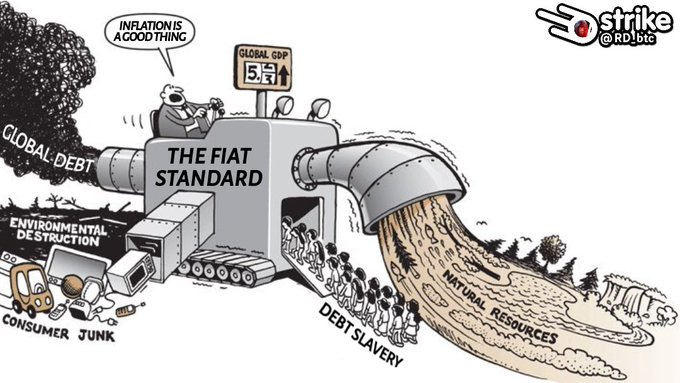

Throughout history monetary systems have been subject to corruption and manipulation because governments have never been able to resist the temptation to inflate the money supply to solve short-term political problems. This has produced dire consequences that include societal moral rot, war and slavery. Central banks working under the direction of governments and in tandem with commercial banks enjoy a monopoly over the issuance of currency thus becoming a de facto centre of power. This power, coupled with the cost of issuance of currency that is almost zero and with no limit to the quantity of money that can be created, guarantees the annihilation of purchasing power of existing currency in circulation over time. It therefore comes as no surprise then that the most “bloodiest” century in history was also the century of central banking.

In part 1 we explored the link between expansion of the money supply that leads to higher prices (i.e. inflation) and time theft. Understanding this link is very important because without accurately comprehending the problem, it becomes impossible to shield yourself from the consequences produced by it. In part 2 we will explore this idea further with a particular emphasis on the monetary properties that make Bitcoin the antidote.

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Henry Ford

In his “Communist Manifesto” (1848), Karl Marx called for “measures” that would usher in monetary socialism. Marx’s fifth measure states: “Centralisation of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly.” (2) Centuries later Marx’s dream has come true as the world now runs on fiat money that is controlled by the central banks he alluded to above. In a fiat system, money is created through credit expansion and its value is not derived from the gold that is held by the central bank. Fiat currencies are debt-backed currencies. For example, other factors held constant, the value of the dollar is largely due to the relative scarcity of dollars to dollar-denominated debt i.e. there has to be more debt in the economy than dollars in circulation. Future demand for dollars is created by debt as one would need dollars to repay dollar-denominated debt.

(3)

Debt creates the ultimate incentive to demand dollars since each dollar in circulation represents a claim on real world assets. As long as dollars are scarce relative to the amount of outstanding debt, the dollar maintains relative stability. This is how the fiat monetary system works; incentivize credit creation and you simultaneously create the source of future demand for the underlying currency. In order to sustain the amount of debt in the system, central banks have to steadily increase the money supply otherwise the credit system would collapse. Increasing the money supply also has the effect of devaluing the currency gradually over time. This is all by design. Print more money; create more debt. Too much debt? Print more money, and so on. To put it plainly the system is designed to keep YOU in debt in perpetuity.

Scarcity is probably the most important characteristic of monetary assets as it ensures that prices of goods and services are not continually distorted; and as is the case with any monetary asset, it’s also one of the monetary properties that props up fiat money. Fiat scarcity is relative to the amount of credit in the system; Bitcoin scarcity is absolute i.e. a pre-determined 21 million maximum supply. The fiat system is based on trust; Bitcoin is trustless. Fiat money supply is controlled by a central bank, whereas Bitcoin's supply is governed by a consensus of market participants. A real life working example of “rules without rulers”.

The supply of fiat money will always be a derivative of its credit system, whereas the supply of Bitcoin is entirely divorced from the function of credit. And, the cost to create dollars is marginally zero, whereas the cost to “mine” Bitcoin is tangible and quantifiable. (4) The absolute scarcity of Bitcoin makes it the most ideal inflation hedge. It’s the best tool so far that insulates you from the downsides of central bank Marxism.

In the same way that you can’t out-train a bad diet, you can’t out-work a bad currency. An annual salary increase that is below the real rate of inflation is simply a form of treading water. What good does a 10% salary increase do against a 20% inflation rate? The typical mutual funds (aka unit trusts); index funds, ETF’s or “diversified stock portfolios” don’t offer much of a shield either, generally speaking, because they are derivatives of the fiat system.

Furthermore these products are usually optimized to beat or track market performance (which most of them fail to do) and not to outpace inflation. Bitcoin’s average roi of 160% annually far outpaces the typical inflation rate; while outperforming most financial assets. The graph below further highlights the value of different currencies and gold over time measured in Bitcoin terms. A picture is indeed worth a thousand words.

(5)

“Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term 'inflation' to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation.”

Ludwig Von Mises

During war some nations sought to inflict harm on their enemies by producing large counterfeit quantities of their enemy’s currency in an effort to trigger hyperinflation. The Nazis attempted to deploy this tactic against the British; the Japanese also experimented with this tactic of economic subversion. More recently this tactic was also deployed by Iran against Iraq after the fall of Saddam Hussein to derail Iraqi rebuilding efforts. According to a US Army psychological operations specialist, Spc. David Lalonde, "Introducing counterfeit money into an economy can be considered to be economic warfare. It will destabilize an economy, inflate prices, and reduce the value of the currency." (6) Counterfeiting and printing money are two sides of the same coin. The bigger question is, when central banks print more money and slowly debauch the currency is this not a form of economic warfare? Are rising prices just an effect of “unintended consequences?” I wonder.

Inflation isn’t a “transitory” harmless phenomenon; it’s the devaluation of a country’s currency that makes “everyone” poorer. It’s also a tool of waging economic warfare and wealth redistribution. The biggest danger of inflation lies not in the subsequent rise in prices of goods and services but in its ability to destroy wealth creation. Increasing prices are only a signal that new money has entered into the economy without an increase in production to absorb the additional money supply. If money is a tool for trading human time then its loss in value due to monetary expansion is also a devaluation of human time represented by that money.

Bitcoin circumvents this phenomenon by having a constant and decreasing rate of issuance of “coins”. This rate of issuance is independent of market forces but is algorithmically programmed into the Bitcoin protocol. Every 10 minutes a new Bitcoin block is mined, 24/7, and every four years the number of Bitcoin that can be mined per block decreases by 50%. After the 2020 “halving” approximately 6.25 Bitcoin are mined per block every 10 minutes, without fail and without central bank coordination; regardless of what the Bitcoin price does or whether China bans it for the umpteenth time. This rate is not subject to the whims and opinions of central planners.

What does all this mean for you? In short, it means that no single entity can inflict its will on the network to increase money supply arbitrarily. Over time the value of your Bitcoin (and your time) is preserved. This is antithetical to the fiat system which destroys value over time. Yes Bitcoin price is volatile in the short to medium-term but price is a misleading signal for a monetary network in its infancy that is slowly repricing the entire global economy with an estimated $250 trillion worth of financial assets. As Satoshi said, “It might make sense just to get some in case it catches on. If enough people think the same way that becomes a self fulfilling prophecy.”

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

Satoshi Nakamoto

Imagine waking up one day and all the money in your bank account is gone. How would you come to terms with the fact that the only money on your person is all you have left? How would you survive? While this might sound like a scene from a dystopian movie a recent example of this occurred in Cyprus. In 2013 Cyprus experienced a financial crisis which had largely been triggered by the exposure of the local banks to an overleveraged property market and the Greek debt crisis. Long story short the country required a bailout of 17 billion Euro. The IMF and the European Central Bank agreed to chip in with a maximum of 10 billion Euro, on the condition that the government of Cyprus was to cough up the 6 billion Euro owed to the country’s creditors.

The government decided to raise the money by confiscating a large chunk of bank deposits in Cypriot banks. Depositors with account balances of €100 000 and above had 60% of their money confiscated without their consent. (6) Savers, pensioners and small businesses (i.e. middle class people) were the hardest hit by this “once-off tax”. The government of Cyprus passed the buck to its citizens, most of whom were not architects of this crisis to begin with. A bank holiday that eventually lasted twelve days was announced as a measure to avert a bank run. ATM’s across the country dried up. When the banks eventually reopened capital controls were introduced that limited withdrawals to a daily maximum of €300 and travellers were not allowed to take more than €1 000 out of Cyprus.

(5)

Such a “once-off tax” as highlighted above would have been impossible to execute had these depositors kept their money in Bitcoin. Firstly without access to your wallet’s private keys (think of it as a password) no one can seize or confiscate your Bitcoin. They can only be transmitted voluntarily by the holder of the private keys; not by a government, bank or tech company. This makes Bitcoin censorship resistant by design. Secondly due to its decentralized nature no single financial intermediary holds the power to approve or stop transactions on the Bitcoin network. This creates a distributed currency and payment system that is simultaneously secure, open, and global. Capital controls like the ones imposed on Cypriots or the subsequent “banking holiday” would not have stopped or limited Bitcoin transactions in any way. Value is transferrable to anyone globally on a permissionless basis, 24/7, 365.

The question to ask yourself is this; if a similar event was to happen in your country today would you be protected against it? Would you still be able to feed your family or plan for the future? ”. When you take a second look at your finances and investments are they safe from confiscation, “legally” or otherwise? Most may dismiss this as highly unlikely but precedence was set for it in an EU country that was once hailed as a “tax-haven. Food for thought.

“A private central bank issuing the public currency is a greater menace to the liberties of the people than a standing army. We must not let our rulers load us with perpetual debt. No generation has a right to contract debts greater than can be paid off during the course of its own existence.”

Thomas Jefferson

In this brief essay we have barely scratched the surface of the dangers of inflation and some of its major causes however one thing is for certain; the fiat money system is designed to steal your wealth and time via inflation, and your freedom via debt. Ranting against the fiat system is mostly good for raising awareness but the most important thing you can do today that’s within your control is how and where you allocate your finances. The choice is between putting your money in an untouchable and appreciating asset or in the same institutionalized system that is designed to gradually siphon your wealth and time. The choice is yours. Bitcoin is more than just an “investment opportunity”, it’s a financial lifeboat. It’s an alternative to an imposed monetary system and an equal opportunity mind-bender.

Acknowledgements

1. Breedlove, Robert. Masters and slaves of money. Medium. [Online] [Cited: 22 January 2022.] https://breedlove22.medium.com/masters-and-slaves-of-money-255ecc93404f.

2. Polleit, Thorstein. Why Marx Loved Central Banks. Mises Institute. [Online] [Cited: 23 January 2022.] https://mises.org/wire/why-marx-loved-central-banks.

3. Board of Governors of the Federal Reserve System (US). Monetary Base; Currency in Circulation [MBCURRCIR]. FRED, Federal Reserve Bank of St. Louis. [Online] [Cited: 23 January 2022.] https://fred.stlouisfed.org/series/MBCURRCIR.

4. Lewis, Parker. Bitcoin is not backed by nothing. Unchained Capital. [Online] [Cited: 23 January 2022.] https://unchained-capital.com/blog/bitcoin-is-not-backed-by-nothing/.

5. —. Bitcoin bbsoletes all other money. Unchained Capital. [Online] [Cited: 23 January 2022.] https://unchained.com/blog/bitcoin-obsoletes-all-other-money/.

6. US Army. Iraqi Police Confront Counterfeiting. US Army. [Online] [Cited: 24 January 2022.] https://www.army.mil/article/39370/iraqi_police_confront_counterfeiting.

7. Customers at Cyprus' biggest bank stung by 60% raid on savings. Independent. [Online] [Cited: 22 January 2022.] https://www.independent.co.uk/news/world/europe/customers-at-cyprus-biggest-bank-stung-by-60-raid-on-savings-8555078.html.

8. Islam, Faisal. Sign at Larnaca airport limiting all currency exports to €1000. Some searches happening. Twitter. [Online] [Cited: 23 January 2022.]

It’s different when The Master Of The Universe Does Something! Thank You.. 🙏 😊