“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.”

Alan Greenspan

In the 3rd century AD, the Roman economy was in crisis. Inflation was rampant and barter was now the dominant form of trade across the empire. Political instability ensued and from 235 – 284 AD, there were more than 50 emperors that ruled the declining empire. Most of them were murdered, assassinated or killed in battle. When Constantine became emperor in 306 AD he successfully reunited the empire which had split into three states; and moved the capital from Rome to Constantinople (modern day Istanbul) marking the birth of the eastern Roman Empire.

He also instituted economic reforms to stabilize the monetary system. A new gold coin, the Solidus (Latin for solid), was introduced to curb inflation and contained 1/72 of a pound (4.55g) worth of gold. As a result the Eastern Empire flourished while the economy of the West continued to decline through debasement of the coinage and the widespread use of barter. The Solidus became the standard throughout the Roman/Byzantine Empire and was widely used for international trade, without experiencing any serious depreciation in its value until the eleventh century.

On August the 15th 1971 President Richard Nixon shocked the world when he “temporarily suspended” the dollar’s convertibility to gold. This temporary suspension became permanent thus officially bringing to an end the Bretton-Woods system which pegged the value of the dollar to gold and allowed other central banks to redeem their dollars for gold. The dollar became a free-floating fiat currency (fiat is Latin for “let it be done”) overnight and subsequently every other currency in the world as they are all dollar derivatives. In comparison to the Solidus that lasted for over 1 000 years, the current fiat monetary system is barely 50 years old and is still largely an ongoing economic experiment. Most of us who were born after 1971 don’t see anything wrong with the current fiat monetary system and we have come to accept it as being normal.

This is in part due to the fact that most of us don’t know what money really is and also due to the opaque nature of our current monetary system. It’s only by going back to first principles and asking the fundamental question, “What is money?” do the inherently dangerous cracks in the system become apparent. For example, one of the major flaws of the fiat system is that it enables deficit spending by governments. Weimar Germany, Venezuela and Zimbabwe are some examples to draw lessons from about the dangers of deficit spending. The coronavirus pandemic greatly accelerated deficit spending as policymakers sought to cushion their citizens from the impact of lockdowns by doling out trillions of dollars worth of stimulus cheques. As inflation continues to climb ever higher spurred on by rising government debt the importance of Bitcoin as an alternative will become obvious to many.

One of the reasons gold has been the best alternative to fiat currencies for centuries because its purchasing power is independent of government policies. Fiat currencies emerged as gold receipts as transporting gold between long distances proved cumbersome and unsafe, thus leveraging on gold’s monetary properties. Without gold, fiat currencies wouldn’t exist today in their current form. Bitcoin disrupts gold, the foundational layer of all analogue societies and while it is analogous to gold; its monetary properties are far superior to those of gold and fiat. A combination of cryptography, a transparent monetary policy based on consensus rules which are enforced by a network of decentralized nodes (A full node is a computer that maintains a full version of the Bitcoin blockchain), and an immutable ledger of transactions whose integrity is guaranteed by a network of miners; reinforces and secures the monetary properties of Bitcoin.

What does all this have to do with you? Well considering that we spend most of our time working for money numerous questions come to mind. If the monetary system upon which our civilization is based on is fundamentally flawed what is the true value of your labour? Will you continue to work exponentially harder each year just to remain in the same place financially? What are the implications for your investments? Will your stock portfolio outpace inflation? Will your retirement portfolio be shielded from inflation? Will you be able to afford retirement? I could go on but I am sure you get the point.

The current fiat system is likely to fail or breakdown to a very large extent at some point in the foreseeable future. Without understanding what money really is, it is extremely difficult to understand why Bitcoin is necessary and why owning it is currently the best form of insurance against a cataclysmic failure of the financial system. Even if this never happens in our lifetime Bitcoin still remains as the best store of wealth over time when compared to a plethora of traditional fiat based investment instruments.

(1)

“Money is not an invention of the state. It is not the product of a legislative act. Even the sanction of political authority is not necessary for its existence. Certain commodities came to be money quite naturally, as the result of economic relationships that were independent of the power of the state.”

In his book Zero to One, Peter Thiel the co-founder of PayPal, in describing the initial mission of PayPal said, “At least PayPal had a suitably grand mission—the kind that post-bubble skeptics would later describe as grandiose: we wanted to create a new internet currency to replace the U.S. dollar.” (2) While the reasons for such a “crazy” mission are numerous the one thing that is glaringly obvious is that the fiat monetary system is fundamentally flawed. More importantly, this mission to replace the dollar wasn’t something that was directed or influenced by any government agency. It was born out of the desire to come up with a better form of money for the 21st century. This wasn’t the first time that someone had attempted to create an internet currency and as you already know by now, it wasn’t going to be the last. PayPal did end up pivoting from this mission at a later stage but the need for a new monetary system to replace fiat still remained.

It’s very easy to criticise the fiat monetary system without answering the most important question; what really is money? Is it gold or silver or the dollar? Money can be defined as a universal medium of exchange, a technology that enables the transfer of value across time and space. Money is also a tool for thinking about and measuring the value of different goods and services. Building more on this idea we could also say it’s an extension of your thought processes. This is why manipulation of the monetary system is dangerous because it distorts your understanding and calculation of true value. In short, it’s a form of brainwashing. Money is simultaneously energy as well as a tool for harnessing and channelling energy efficiently. Money is more than just a piece of paper with a politician’s face on it, and best of all; it’s not a creation of the government. To sum it all up; Money is the universal medium of exchange, a technology for transferring value across time and space, an extension of your mind to think of value, and a form of energy that is a claim on all other forms of energy.

For anything to be considered as money it must satisfy the following five properties:

· Divisible

· Portable

· Durable

· Recognizable

· Scarce

For thousands of years gold has best satisfied the above properties of money and remained undisputed in this role before the advent of Bitcoin. Fiat currencies satisfy all of the above characteristics except the last, scarcity because there is no limit to how much of it can be created. The demand for money must always exceed its supply and with fiat money the reverse is true thus giving rise to inflation.

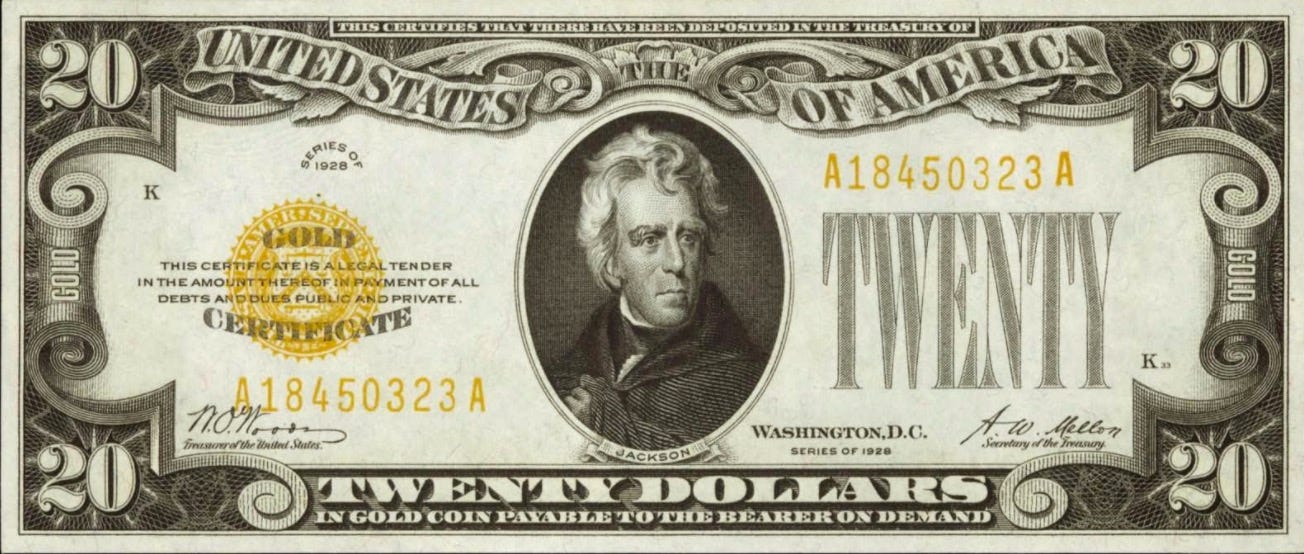

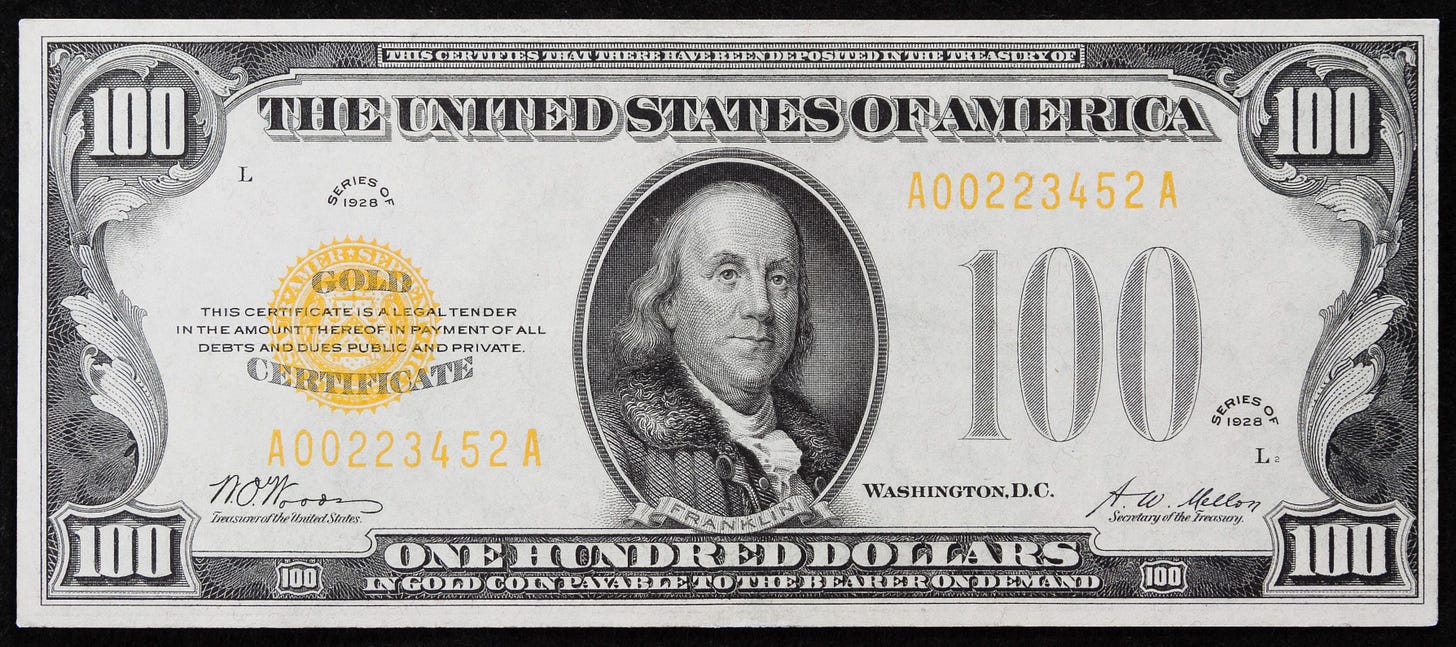

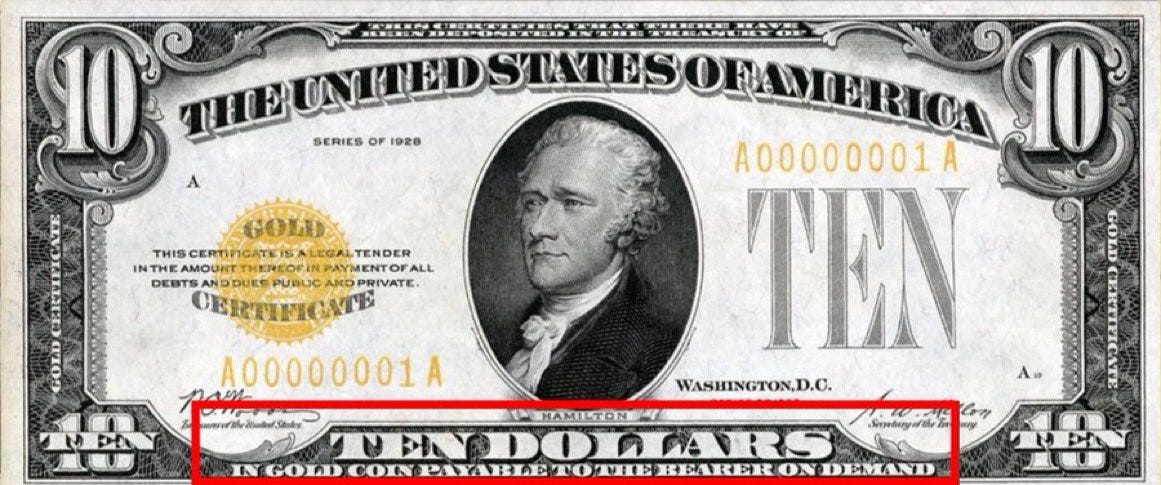

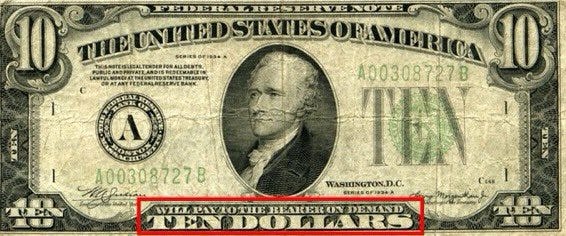

Over time fiat currencies transitioned from being gold-backed currencies to being debt-backed currencies; the details of which are discussed in depth in “Inflation is time theft”. The table below gives you a historical snapshot of this transition of gold with the dollar:

(3)

Unlike gold, the value of fiat currencies didn’t emerge from the free market and neither was it purely based on the monetary properties we have outlined above. Fiat currencies started out as fractional representations of gold. Paper money was a solution for the inherent limitation for the portability of gold and it was actually an IOU or a receipt that could be redeemed for gold at any time. The current fiat monetary system was born out of this shortcoming of gold. This portability limitation led to gold custody being centralized by the banks as they eventually started issuing more “paper receipts” that exceeded the amount of gold in custody. This violated the trust upon which this entire system was built on where you accepted paper money today with the understanding that it could be redeemed for a fixed amount of gold at some point in the future.

(4)

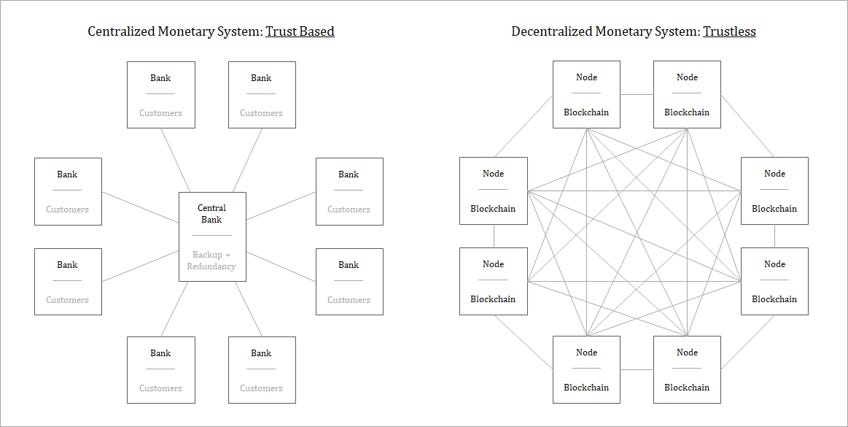

This same trust violation still continues today. We too trust central banks to manage and maintain the stability of the money supply as the sole issuers of currency; and therein lies the problem. As Satoshi noted, “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” If history is any guide the temptation to overinflate the money supply by a central authority is yet to be overcome. Whether it’s to finance the next war or “building new infrastructure” or to seek re-election, politicians will always have an incentive to expand the money supply in the short-term which comes at the cost of the decline in purchasing power of your money in the long term. This is one of the reasons why Bitcoin was invented: so that you could choose to either shoulder the risk of a flawed monetary system, or take the responsibility of self-sovereignty.

“I believe that to solve any problem that has never been solved before, you have to leave the door to the unknown ajar.”

Prof Richard Feynman

In sharp contrast to the fiat system Bitcoin is a trustless monetary network that is not dependent on trusting any third party for it to function. Satoshi explained the importance of a trustless monetary network in the Bitcoin whitepaper with the following statement, “What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” (5)

(3)

Full nodes independently combine a version of the blockchain based on a common set of network consensus rules and each node validates all transactions. Anyone can run a full node, access the Bitcoin network and broadcast transactions on a permissionless basis. Nodes do not need to trust any other nodes. This is because each node independently audits the complete history of Bitcoin transactions according to a common set of rules, allowing the network to converge on a consistent and accurate version of transaction history on a trustless basis.

A history of all transactions is maintained by all nodes, allowing each node to determine the validity of any future transaction. The network is fully decentralized with no single points of failure. Each node is a check and balance on the rest of the network, and without a central source of truth, the network is resistant to attack and corruption. This is the most secure computing network in the world because anyone can access it and it is 100% trustless. It’s possible that any node could fail or become corrupted, but even if this occurred, the rest of the network would not be impacted. As the number of nodes on the network increases, Bitcoin becomes more decentralized thus making the network more resistant to corruption and censorship. This is the mechanism by which the Bitcoin network removes trust in any centralized third-party. (3)

While the above may be a bit technical for some the most important thing to grasp is that the trustless nature of Bitcoin makes the network fully transparent with no single entity having the power to arbitrarily change the rules of the network without consensus of all participating nodes thus ensuring equal property rights to all Bitcoin hodlers regardless of the economic value of the Bitcoin they hold. Unlike in Animal Farm, no animals are “more equal than others.” The significance of this breakthrough cannot be emphasized enough as the reverse is true in the fiat monetary system. Furthermore someone living in Lagos, for example, who holds Bitcoin is now largely insulated from decisions made in Washington DC unlike his peer holding their savings in dollars.

“Money is the nerve centre of the economic system. If, therefore, the state is able to gain unquestioned control over the unit of all accounts, the state will then be in a position to dominate the entire economic system, and the whole society.“

Murray Rothbard

Literacy is not a natural ability that we are born with but it’s a psycho-technology that enhances our mental processes, problem solving skills and cognition. Prior to the invention of the printing press in 1440, only 20% of English adults were literate and these were mostly upper class elites. Books existed in the form of scrolls and were mostly written by hand making them very expensive and rare to come by. The cost of a book in the 14th century was equivalent to the cost of a house. (6) The invention of the printing press made it possible to mass produce books at a lower price leading to the democratization of access to knowledge to the general public. As a result literacy rates rose and by 1800, 62% of English adults were literate. The scientific revolution, the renaissance, and the protestant reformation wouldn’t have had much of an impact or even gotten off the ground had it not been for this newfound superpower to disseminate information inexpensively to many people. This enabled more collaboration than ever before while accelerating the spread of ideas. The immense role that the printing press played in the reformation was perfectly summarized by the theologian Martin Luther when he said, “Printing is the ultimate gift of God and the greatest one.”

Money makes it possible for us to communicate, measure and think about the value of different goods and services. It too is a psycho-technology, for without it economic calculations would be almost impossible. How would it be possible to efficiently run a business without the ability to do accurate economic calculations? Even double-entry accounting evolved from the need to accurately track and record financial transactions. The major problem today however is that, just like the period before the invention of the printing press, financial illiteracy is pervasive in our society despite us being in the “information age.” I don’t mean financial illiteracy in the traditional sense of not understanding basic concepts of financial management, but in the fundamental sense of failing to grasp what money really is and what it is not. This is partly the reason why a lot of malinvestment occurs across the board from an individual level all the way up to the national level. How can one make competent financial decisions when their understanding of money is extremely flawed?

Bitcoin is an invention that has disrupted every premise of the centralized financial system that we inherited. Bitcoin challenges the fundamental premises of the legacy system that a little inflation is acceptable, or that controlling your own funds is very risky, or that central planners know best and so on. Having “a little inflation” is a violation of your property rights because it’s a form of confiscation of your wealth through the backdoor. A new, opt-in environment that is fundamentally distinct from the status quo had to be built from the ground up. As the cracks in the fiat system become more evident, every economic indicator within the system will be corrupted. Some countries have even censored real inflation rates with a recent example being Turkey where the president fired the head of the statistics agency for publishing record high inflation rates. The only way to bet and win against the system is from the outside. Bitcoin is the exit.

Sources

1. Leftover Currency. Twenty Dollars Gold Certificate yellow seal. Leftover currency. [Online] [Cited: 3 February 2022.] https://www.leftovercurrency.com/app/uploads/2017/03/twenty-dollars-gold-certificate-yellow-seal-1.jpg.

2. Thiel, Peter. Zero to One Notes on Startups, or How to Build the Future. New York : Crown Business, 2014.

3. Lewis, Parker. Bitcoin is not backed by nothing. Unchained Capital. [Online] [Cited: 03 February 2022.] https://unchained.com/blog/bitcoin-is-not-backed-by-nothing/.

4. BTC, Documenting. A short history of money. Twitter. [Online] [Cited: 3 February 2022.]

5. Nakamoto, Satoshi. Bitcoin: A Peer-to-Peer Electronic Cash System. Bitcoin. [Online] [Cited: 3 February 2022.] https://bitcoin.org/bitcoin.pdf.

6. History. 7 ways the printing press changed the world. History. [Online] [Cited: 4 February 2022.] https://www.history.com/news/printing-press-renaissance.

The article provides a broad understanding of critical issues of money and a fundamental solution to the existing and detrimental effects of inflation - the bitcoin. Everyone should read this article if they want to have a clearer view of what money is and what can be utilized to be protected from the risks of inflation.

BRILLIANT THINKING IS RARE, BUT COURAGE IS EVEN IN SHORTER SUPPLY THAN GENIUS.( PETER THIEL) WELL AFTER READING SUCH ARTICLES YOU UNDERSTAND THAT ONCE IN 100 YEARS GOD GIVES SUCH A GREAT GIFT TO THE WORLD THAT HAS IT ALL - GENIUS, HAS BRILLIANT THINKING AND COURAGE! THANK YOU!